For many employers, the outbreak of COVID-19 and related measures mean that they cannot currently assign work to their employees in the same extent as before, or are required to order their employees to work from home.

Some employees may be compulsorily quarantined or have to stay home with their children because the schools have been closed down.

Compulsory testing of employees

With effect from 23:59 on Friday 18.02.2022 the compulsory testing of employees has been terminated.

Kurzarbeit - or contribution at the time of partial work

On May 7, 2021, the Chamber of Deputies approved a bill on the so-called kurzarbiet or partial work. It should help employers to reduce the effects of the epidemic, but also natural disasters, cyberattacks or times of economic threat (it was necessary for the government to activate the exchange rate).

Kurzarbeit could be ordered by the employer for a maximum of 6 months, with the possibility of extending it twice by 3 months each time, i.e. a total of 1 year.

In the case of Kurzarbeit, employees will therefore receive a wage compensation of at least 80%. In these cases, employers could be entitled to wage compensation, including levies, paid to employees in the amount of 4/5 of the amount paid, up to 1.5 times the average wage, for those employees whose employment lasts at least 3 months.

The employer would have to notify the employment office electronically of the use of the kurarbeit, and if he sent a monthly statement of wage compensation costs in time, he could receive the allowance before the employees were paid.

When using a course work, the employer must not:

- pay dividends or other profit sharing one month before the start of the exchange rate and 1 year after its end

- repay the loan early, within the same period as in the case of profit sharing

- dismiss employees after the end of the course work (prohibition of dismissal lasts 1/2 of the time of drawing the allowance)

- have an agreed working time account with employees, resp. the contribution cannot be drawn on these employees

Employers are not entitled to a course allowance for a period of 3 years if they have been fined for illegal employment.

The law must now be approved by the Senate and signed by the President.

Extraordinary allowance for employees, so-called isolation-allowance

On 4 March 2021, the Senate approved an extraordinary allowance for employees, so-called isolation-allowance.

This allowance in the amount of max. CZK 370 / day will be paid by employers to employees in two cases:

if an employee is ordered to quarantine

if an employee stays at home in isolation because of the symptoms of an infectious disease (Covid 19).

The aim of this allowance is to motivate people to stay at home and be tested for symptoms of illness, thus preventing the further spread of the coronavirus pandemic.

The allowance will be paid in addition to sick pay, which will significantly reduce the decrease of employees' salary.

Thanks to the isolation-allowance, the employees on sick leave will receive up to 90% of their average earnings.

The allowance will be paid for no longer than the first 14 calendar days of the ordered quarantine or isolation.

Exceptions are cases where the employee was ordered quarantine within 5 days from the date of his return from abroad, with the exception of business or business trips.

The employer can deduct the amount of the allowance paid to the employee from the amount of the insurance premium payable for the calendar month.

The payment of the isolation-allowance has been prolonged until 30 June 2021.

Attendance allowance

An employee taking care of a child younger than 10 years is entitled to time off work for a period of 9 nine days; this care allowance is covered by the state.

We would like to point out that a legislative proposal has been adopted under which the child’s age limit will be increased to 13 years; the period of 9 days will be extended for the entire duration that schools remain closed.

Furthermore, on October 21, the Chamber of Deputies has approved crisis care allowance for the parents of the children attending the closed school. The crisis care allowance is supposed to stay in force during the whole period for which the emergency measures are effective, starting from the declaration of the state of emergency, with the latest possible date of their effectiveness being 6 June, 2021.

The crisis care allowance has following parameters

The allowance can be claimed by parents of a child younger than 10 years

The care allowance is 70 % of the daily assessment base, with minimal amount being CZK 400.

The care allowance can also be claimed by persons working on short-term work agreements, as long as they are a part of the sickness insurance system.

The parents can substitute each other in the care of the child without any limitations, including changes in care during one day.

The care allowance can be claimed as long as the schools remain closed or the person raising the claim is employed.

Compulsory quarantine

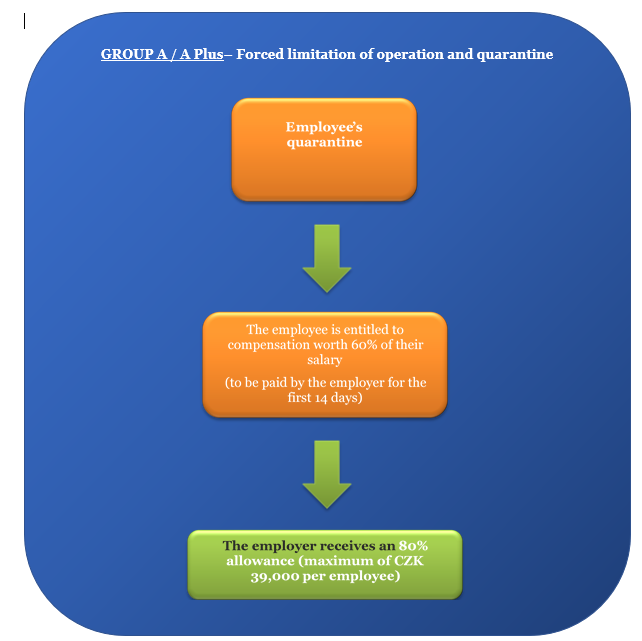

In this case, normal regulations in respect of one’s regular incapacity to work apply. This means that for all days exceeding the first 14 days, the employee is entitled to compensation of 60% of their salary.

In this case, normal regulations in respect of one’s regular incapacity to work apply. This means that for all days exceeding the first 14 days, the employee is entitled to compensation of 60% of their salary.

According to the newly adopted “Antivirus” programme, the employer shall be entitled to an 80 % reimbursement of this allowance.

What to do with employees for whom there is currently no work?

Vacation time

The employer may order their employee to take his/her vacation time. The employer must request their employee take his/her vacation time at least 14 days in advance unless agreed otherwise with the employee. If an employee had planned his/her leave vacation for a different time of the year (e.g. summer), the dates can be changed. Again, the employee must be notified 14 days in advance (unless otherwise agreed), and bear in mind that in such a case, the employee can claim compensation for any costs incurred due to their having to reschedule any vacation that had been previously approved, such as cancellation costs with travel agents. Therefore, it is advisable to communicate possible vacation cancellation with employees in advance and cancel any vacation that had been previously approved ideally only if no related costs are incurred.

The employer may order their employee to take his/her vacation time. The employer must request their employee take his/her vacation time at least 14 days in advance unless agreed otherwise with the employee. If an employee had planned his/her leave vacation for a different time of the year (e.g. summer), the dates can be changed. Again, the employee must be notified 14 days in advance (unless otherwise agreed), and bear in mind that in such a case, the employee can claim compensation for any costs incurred due to their having to reschedule any vacation that had been previously approved, such as cancellation costs with travel agents. Therefore, it is advisable to communicate possible vacation cancellation with employees in advance and cancel any vacation that had been previously approved ideally only if no related costs are incurred.

One practical solution may be to ask an employee to use his/her compensatory leave accumulated for overtime work.

Home Office

In general, there is no need for any special written agreement for an employee to work from home; it is sufficient if the employee grants his/her consent, such as by e-mail, and starts to work without any objections. The situation is different if the employee’s home is located in a place other than the place of work currently agreed to in the employment contract (for example, an employee’s place of work under the contract is the city of Prague, but the employee lives in Mělník). In such a case, from a purely formal perspective, working from home may be interpreted as a change to the place of work (although a temporary one) that requires a written agreement.

In general, there is no need for any special written agreement for an employee to work from home; it is sufficient if the employee grants his/her consent, such as by e-mail, and starts to work without any objections. The situation is different if the employee’s home is located in a place other than the place of work currently agreed to in the employment contract (for example, an employee’s place of work under the contract is the city of Prague, but the employee lives in Mělník). In such a case, from a purely formal perspective, working from home may be interpreted as a change to the place of work (although a temporary one) that requires a written agreement.

We believe that given the current circumstances, labour inspectorates will not strictly interpret the regulation and will not insist on a written form if the place of work is different from the place of work agreed to in the employment contract while working from home.

However, from the legal certainty point of view, we would recommend changing the place of work in writing and entering into an agreement on working from home (including its specifics); such agreement would further define the rights and obligations of the parties.

Prevention from work, partial unemployment (short-time work) In general, a rather strict rule applies to employers that states that if an employer cannot assign work to an employee, the employee is still entitled to their salary. This also applies in situations that were by not caused by the employer. However, certain exemptions apply:

- Downtime: If an employee cannot perform work due to operational reasons (equipment breakdowns, a lack of raw materials), he or she is entitled to 80% of his/her average earnings. This is especially in those cases where the supplier interrupted its work and is unable to deliver key components and/or raw materials.

- Work stoppage due to a natural disaster: According to the Czech Labour Code, employees are entitled to 60% of their salaries if work is interrupted as a result of a “natural disaster”. A discussion is currently under way between employers and the Ministry of Labour and Social Affairs as to whether the coronavirus epidemic and related measures can be interpreted as a “natural disaster”, in which case employees would receive only 60% of their earnings. At the moment, we do not recommend employers adopt this approach, mainly because of the above-mentioned state of legal uncertainty.

On the other hand, partial unemployment might be a practical solution. This occurs where an employer cannot assign work to employees due to a temporary restriction of sales of their products or a decrease in demand for its services. This procedure could be very practical, especially for businesses where operations have been banned or restricted by government measures (such as restaurants).

In such cases, the employee also receives only 60% of his/her salary. This scenario requires approval by the trade union if the employer has one; where a trade union has not been established, the employer must issue an internal regulation and inform its employees about it.

At the same time, it is possible to ask the Employment Authority for an allowance of up to 20% of an employee’s average earnings if the employer agrees to compensate the employee for a minimum of 70% of the employee’s salary. Improving the conditions connected with partial unemployment is currently underway – see the “Antivirus Programme for Business” below.

“Antivirus Programme for Business”

The government has extended the Antivirus program until the end of June 2022, with the period of deductibility of expenses extended to February 28, 2022 for the time being. Under Scheme A of this program, an employer can apply to the Labor Office for a contribution if an employee is ordered to be quarantined or is in isolation due to COVID-19. In such cases, the employer is entitled to compensation equal to 80% of the deductible costs, which consists of the wage compensation paid to the employee and statutory contributions. An employee who is quarantined or in isolation is then entitled to be paid 60% of average earnings. The maximum monthly allowance per employee is CZK 39,000. The application can be filed using the website https://www.mpsv.cz/antivirus. We will be happy to assist you with the application filing.

The Group A scheme is extended until the end of February 2022.

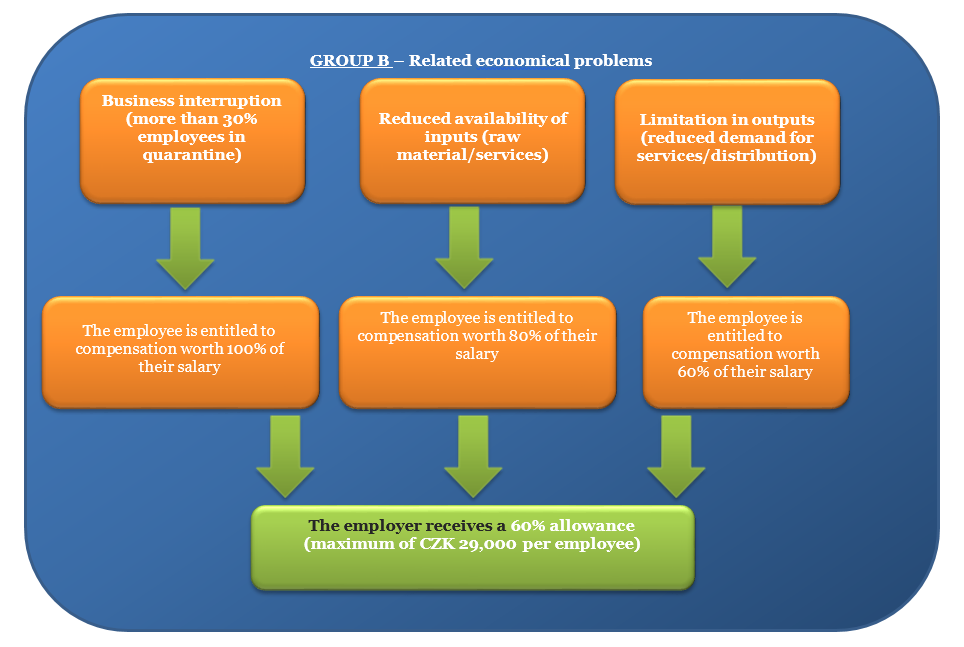

As of 11 November, Mode B of the Antivirus programme has also been renewed and the period of eligibility of expenses ends, as for Mode A, on February 28, 2022. Mode B is intended for companies that have a larger number of employees on sick leave, in quarantine, or have been limited in the inputs necessary for their activities (missing parts, etc.), or the demand for their products or services is limited due to the pandemic. The amount of compensation is 60% of the wages paid, including insurance premiums, with a maximum of CZK 29,000 per employee per month. The amount of wage compensation for employees varies according to the obstacle that prevents them from performing their work, this is detailed in the diagram below.

The Group B scheme has been suspended from 01.01.2022.